Condo Insurance in and around Duluth

Unlock great condo insurance in Duluth

Condo insurance that helps you check all the boxes

Home Is Where Your Heart Is

As with anything in life, it is a good idea to expect the unexpected and strive to prepare accordingly. When owning a condo, the unexpected could look like damage to your unit and personal property inside from theft fire, hail, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Unlock great condo insurance in Duluth

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance protects more than your condo's structure. It protects both your condo and your valuable possessions. If you experience a tornado or a burglary, you could have damage to the items inside your condo in addition to damage to the actual condo. Without adequate coverage, you may struggle to replace all of the things you lost. Some of your possessions can be covered if they are damaged even if you take them outside of your condo. If your bicycle is stolen from work, a condo insurance policy could cover the cost.

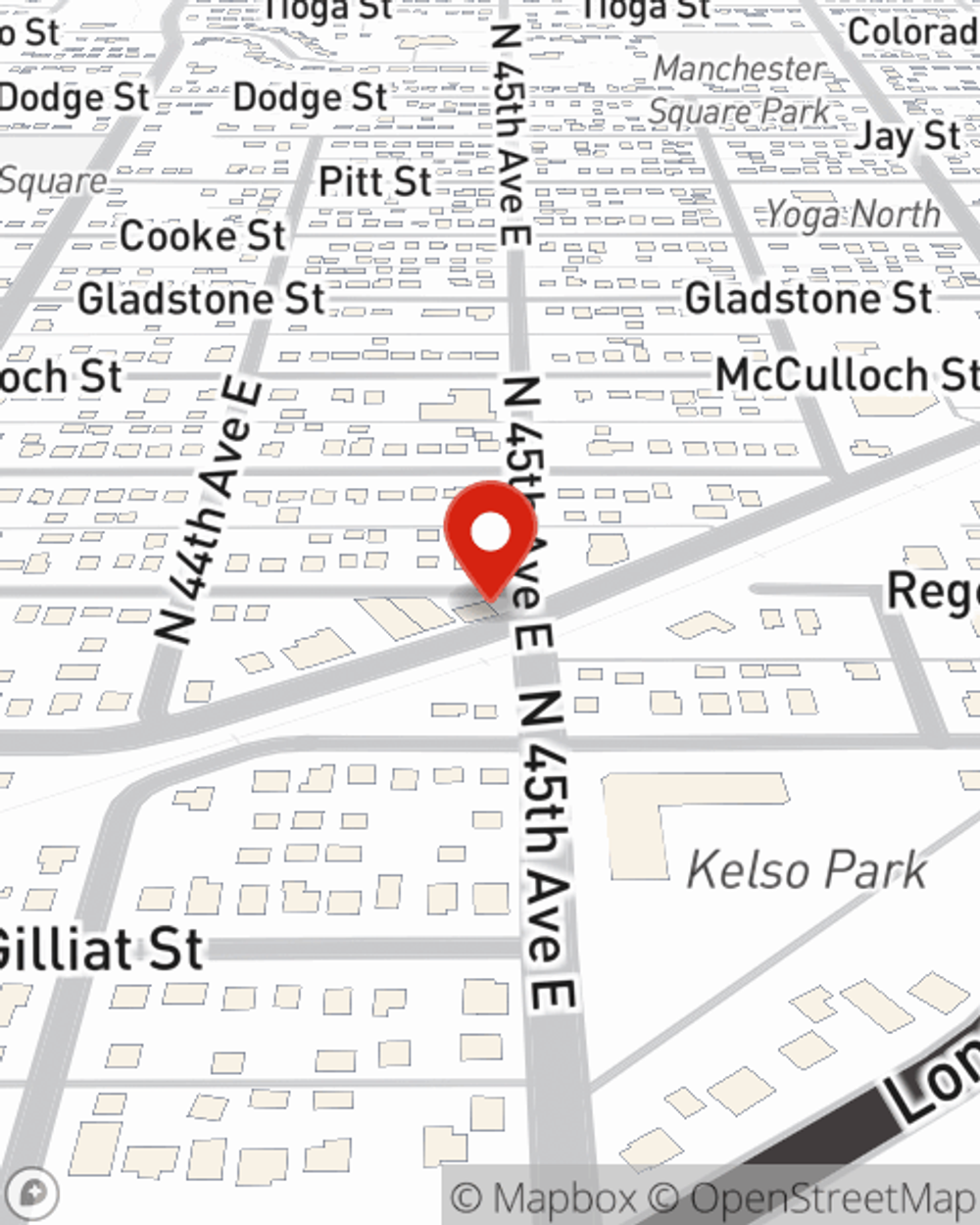

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Contact agent Joe Golcz today for more information.

Have More Questions About Condo Unitowners Insurance?

Call Joe at (218) 525-6623 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.